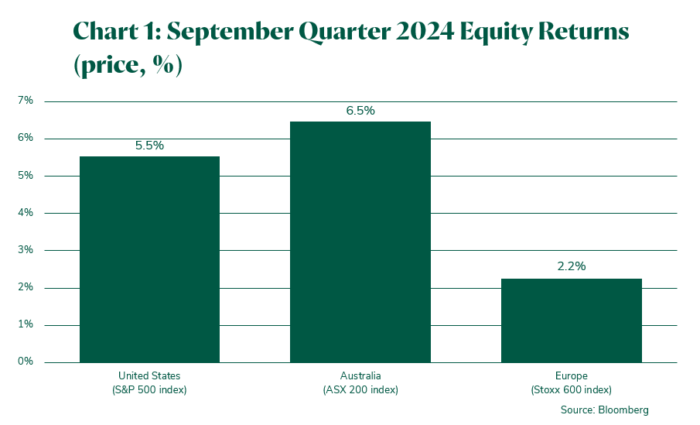

Global equity markets rose strongly in the quarter ending 30 September 2024 (see chart below), following robust performance in the first half of the year. The gains in equity markets during the quarter reflected factors such as a resilient global economy as well as falling US inflation allowing the US Federal Reserve (the Fed) to cut interest rates in September.

While global equity market gains were strong in the September quarter, during some of this period equity markets fell sharply, mainly reflecting concerns about US economic growth. In particular, the US unemployment rate rose sharply in July 2024, increasing the risk that the US economy would begin to experience a recession later this year. These investor fears were only temporary, as there was some subsequent improvement in US economic data and the Fed signalled that it was likely to cut interest rates by more than previously expected.

Global investment cycle

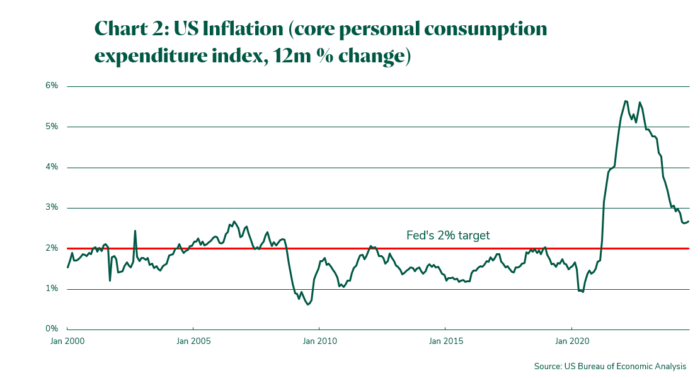

The global investment cycle appears to be moving into a different phase with the Fed shifting its focus from inflation to ensuring that US growth is reasonable. Since 2021, the Fed has been very focused on reducing inflation so that it is consistent with its 2% target. Higher interest rates and reducing supply bottlenecks have resulted in US core inflation moderating materially from its peak level in 2022 – see chart below.

While on an annual basis US core inflation is still above the Fed’s 2% target, the weakening in the US labour market is likely to result in inflation over the next 12 months becoming consistent with the target. Reflecting this, the Fed started cutting interest rates in September.

Outlook

The performance of the US economy is likely to remain an important influence on global investment markets. Most investors believe that the US will achieve a soft landing, with moderate GDP growth expected over coming quarters. The key upside risk to this view is that the economy is resilient and inflation falls more than expected, allowing the Fed to cuts rates by more than is currently expected. A key downside risk is that the economy experiences a recession reflecting the lagged impact of prior interest rate increases.

Another potentially important influence on investment markets is the US election. For example, if Donald Trump is elected President and implements the policies that he has announced, it could be destabilising for equity markets if it results in materially higher inflation and interest rates.

Chinese policymakers have recently announced measures that aim to boost the Chinese economy. While the full extent of the polices that will be implemented is unknown at the time of writing, it appears that this round of stimulus will be considerably greater than the measures announced during the past year or so. Chinese equities have experienced exceptionally strong gains over recent weeks, partly reflecting their low valuations. While the outlook has improved, China is unlikely to experience strong growth on a sustained basis, as it faces several structural headwinds (eg excess supply of apartments, high debt levels and a rapidly aging population).

The recent performance of the Australian economy has been lacklustre, with GDP growth of just 0.2% in each of the past three quarters. Over the year to the June 2024 quarter, the economy has contracted by 1.5% on a GDP per capita basis. Unlike the US, the Australian inflation outlook does not seem to allow the Reserve Bank of Australia (RBA) to cut interest rates in 2024 – for example, the underlying inflation rate (trimmed mean) for the June 2024 quarter was 3.9%, versus a target range of 2% to 3%. That said, consensus expects that inflation will continue to fall and allow the RBA to cut rates in the first half of 2025.

Member Hotline

1300 300 820

Employer Hotline

1300 304 947

Retirement Hotline

1300 017 589