Our name hasn’t changed, and neither has our commitment to personal, award-winning service. But our combined size and strength has already brought some benefits into view for our existing Vision Super members.

Where applicable, our members are now paying less in administration fees and costs – our flat fee for accumulation members of $78pa ($1.50 per week) has reduced to $66.04pa ($1.27 per week). This is on top of the 2% reduction in insurance fees, which came into effect on 1 October 2024.

That’s just the start of the potential benefits we see ahead – our modelling of the impacts of the merger indicates that millions of dollars in operational savings may be achieved in each financial year. These synergies will help keep downward pressure on fees and costs and allow us to invest in strategic initiatives to build on our history of strong performance. Together, our long-term vision is building a sustainable fund with a focus on our members and their retirement outcomes.

To facilitate the merger, a Limited Service Period (LSP) will be in place from 28 February 2025 to no later than the end of 18 March 2025. During this time, some of your account services will be temporarily unavailable, and the processing of some requests or transactions will be paused. Please check your Significant Event Notice to see how this might affect you, including key cut-off dates for activities or requests (to ensure they are processed before the LSP).

Distribution of Significant

event notices to members

will commence

Limited service period

begins

Scheduled SFT date

Normal services are

expected to resume

We recognise that a LSP may affect your ability to manage your super, however it’s necessary to ensure that all Active Super member balances are transferred accurately and securely. This cannot be done without implementing an LSP, during which time we’ll be working to ensure our internal administration systems are changed to operate effectively for all our members

Here you can download the significant event notice relevant to your account, which will provide you with important information about the merger. You should have also received this document via email or post.

The merger involves transferring Active Super members to Vision Super so as an existing Vision Super member, you won’t need to do anything. The successor fund transfer (SFT), which is scheduled to occur on 1 March 2025 (SFT date), is the effective date that Active Super members will be transferred to Vision Super.

There is no change to your member number, account details, account balance, investments or level of insurance cover. Any third-party authority or power of attorney you have made and recorded with us will also remain unchanged, and your login details for your online account and the Vision Super app will stay the same.

For a period from the SFT date there will be some disruption to our services (limited service period) however rest assured we will be doing our best to keep these disruptions to a minimum. For most members, there will be a reduction in administration fees and costs and for any members with a pension, one payment will be brought forward.

The fund (Local Authorities Superannuation Fund) after the merger (merged fund) will still be known as Vision Super.

Active Super is scheduled to merge into Vision Super on 1 March 2025 (SFT date).

You can sit back and relax — your member number and other account details will remain the same.

If you’d like your new employer to contribute to Vision Super for you, the only thing you’ll need to do is nominate Vision Super as your preferred super fund. To take your Vision Super account with you to your new employer, simply complete a Vision Super Choice of Fund form and give it to your employer.

Please note: if you don’t tell your new employer your preferred super fund, your new employer must contribute to your ‘stapled fund’. This is essentially the most recent or active super fund you participate in as advised by the ATO to your new employer. Nominating your preferred fund helps you keep control of what happens to future employer contributions.

We will communicate all necessary information about the merger to your employer and they will continue to pay your contributions as normal. However you should note that the processing of employer contributions will be impacted by the limited service period.

You should have received a significant event notice relevant to the type of account you hold with Vision Super with important information about the merger including information about the disruption to some services to existing Vision Super members (these notices are also available to download via this page). We won’t send another notice when the merger takes place on the SFT date as the merger will automatically happen subject to disruptions and other changes we have notified to you.

For some more details about our merger with Active Super, visit www.visionsuper.com.au/merger. Otherwise, you are always welcome to call us on 1300 300 820 between 8:30am and 5:00pm (AEST) Monday to Friday or email [email protected].

We are focused on delivering strong retirement outcomes for our members so may consider another merger in the future — but only if it is in the best financial interests of our members to do so.

We aim to keep our fees as low as possible and are pleased to be able to offer members a reduction in the administration fees and costs charged to their account from 1 March 2025 – for example, our flat fee for accumulation accounts of $78 pa ($1.50 per week) will reduce to $66.04 pa ($1.27 per week). You can find more details about the changes to fees and costs in your significant event notice.

Whether you have a Vision Super Saver, Vision Personal, one of our pension products or a defined benefit plan, nothing about your account will change. After the merger takes place you’ll remain a member of the merged fund known as Vision Super.

We don’t anticipate there will be any impact on performance and have been working hard to ensure a smooth transition for both our existing and new members.

The only time our services will be affected is as we merge Active Super’s data with our data, when there will be a period of disruption to our services — called a limited service period (LSP). The process of merging two funds is complex, with many checks and balances, and while we recognise that a LSP may affect your ability to manage your super, it is necessary to ensure that all Active Super member balances are transferred accurately and securely.

As we process the merger, we do expect an increase in calls to our contact centre, which may result in some delays, but we will be doing everything we can to minimise wait times. From 1 March 2025, we will have a larger team and will be extending our contact centre operating hours to 6pm.

The limited service period (LSP) is a period of scheduled downtime that allows us to ensure a safe and secure transition. From Friday, 28 February 2025, certain services and transactions for your account will be temporarily unavailable, and the processing of some requests or transactions will be paused. Normal services are expected to resume no later than the end of Tuesday, 18 March 2025.

Online and mobile access will be maintained as much as possible during the LSP. However, from 3pm on Monday 10 March 2025, both Member online and the member app will be read only and then unavailable from Wednesday 12 March until normal services resume no later than the end of Tuesday 18 March 2025.

If you hold an accumulation account, withdrawals will be temporarily unavailable from Tuesday, 4 March 2025 until normal services resume no later than Tuesday, 18 March 2025. If you need to make a withdrawal before the LSP, please ensure we receive your paperwork by the cut-off date of Monday, 3 March 2025 (before 5pm), keeping in mind that postal delivery times vary.

If you hold a pension account (excluding lifetime pensions), withdrawals will be temporarily unavailable from Saturday, 1 March 2025 until normal services resume no later than Tuesday, 18 March 2025. If you need to make a withdrawal before the LSP, please ensure we receive your paperwork by the cut-off date of Friday, 28 February 2025 (before 5pm), keeping in mind that postal delivery times vary.

If you miss the cut-off date, Vision Super will process your transaction as soon as possible after the LSP ends. Forms can be emailed to us at [email protected] or posted to us at: Vision Super, PO Box 18041 Collins Street East, VIC 8003, but please check you have filled in all the required sections otherwise we cannot guarantee that your request will be processed in time.

Urgent payment requests (not involving an insurance claim) received by Vision Super during the LSP may be paid upon application, on a case-by-case basis, where exceptional circumstances exist. Contact us on 1300 300 820 for any urgent requests.

Urgent payment requests (not involving an insurance claim) received by Vision Super during the LSP may be paid upon application, on a case-by-case basis, where exceptional circumstances exist. For example, this includes release of benefits on the basis of financial hardship or compassionate grounds. You can contact us on 1300 300 820 for any urgent requests, noting only partial withdrawals will be permitted in the case of an urgent payment request.

There will be no change to any of your account details during the merger, including while the LSP is in effect. For any members with a pension, one payment will be brought forward during the LSP, but please refer to your significant event notice for further details.

The merged fund will continue to use the existing Vision Super app so you won’t need to download anything new.

As the processing of some requests and transactions will be paused during the LSP, you won’t be able to start a new product until normal service resumes no later than Tuesday 18 March 2025.

If you have a question about the merger during the LSP, and can’t find the answer you’re looking for here, you can call our Member Hotline on 1300 300 820, email us anytime at [email protected], or chat with us online. From 3 March 2025, we will have a larger team in our contact centre and will be extending our servicing hours from 8.30am to 5pm to 8.30am to 6pm weekdays, to help members navigate this transition.

Any employer contributions (including salary sacrifice contributions) that are received during the LSP will be processed (i.e. allocated to your account) as soon as possible after normal services resume around Tuesday 18 March 2025.

Contributions (including employer contributions) received after the cut-off date of Friday 28 February 2025 (5 pm) will be processed using the applicable unit price for the date these transactions are processed. For example, if a withdrawal request received on Tuesday, 4 March 2025 is processed on Wednesday 19 March 2024, the applicable unit price calculated for Wednesday 19 March 2024 will apply. This arises because the processing of transactions cannot occur during the LSP, while internal system changes are being made.

Your transaction history won’t be updated until after normal services resume around Tuesday, 18 March 2025, which is when we will start processing contributions received during the LSP. A good way to check if your employer has made the required contributions is via your payslip.

You can continue to access your information and statements online, but from 3pm on Monday, 10 March 2025, both Member online and the member app will be read only. They will be temporarily unavailable from 2pm on Saturday, 15 March until no later than the end of Tuesday, 18 March 2025.

Your contributions will continue but any contributions that are received during the LSP will be processed (i.e. allocated to your account) as soon as possible after normal services resume around Tuesday 18 March 2025.

Contributions (including employer contributions) received after the cut-off date will be processed using the applicable unit price for the date these transactions are processed. For example, if a withdrawal request received on Tuesday 4 March 2025 is processed on Wednesday 19 March 2024, the applicable unit price calculated for Wednesday 19 March 2024 will apply. This arises because the processing of transactions cannot occur during the LSP, while internal system changes are being made.

If you need to make any changes to your account before the LSP, such as changing your email or mobile phone number, adding a third-party authority or power of attorney, or making or updating a beneficiary nomination, please check the key cut-off dates in your significant event notice. The cut-off date may vary depending on whether your instruction is received by mail/email or via Member online/the member app. Some key cut-off dates are specific to particular products, so please check the relevant significant event notice if you hold multiple Vision Super products.

During the LSP, our contact centre can assist you with general account information and education. You can call our Member Hotline on 1300 300 820 or email us anytime at [email protected]. From 3 March 2025, we will have a larger team in our contact centre and will be extending our servicing hours from 8.30am to 5pm to 8.30am to 6pm weekdays, to help members navigate this transition.

There will be no change to your level of insurance cover as a result of the merger. We have already seen a 2% reduction in insurance fees across Vision Super’s insurance offerings, which came into effect on 1 October 2024.

You can still lodge an insurance claim during the limited service period. Call our contact centre and they can help you make a start.

There will be no change to the beneficiaries you have nominated as a result of the member, whether that nomination is preferred or binding. If you have already made a binding nomination, we have simplified the process to re-make the nomination upon expiration after three years (alternatively you can make a new nomination before or after any current binding nomination you have in place).

There will be no change to the option(s) you are invested during the merger unless you choose to switch your investment options. Please note that that investment option switches will be temporarily unavailable during the limited service period.

If you want to make any changes to your investments before the LSP and hold an accumulation account, we’ll need to have received your paperwork before 5pm on Monday, 3 March 2025 or you’ll need to have updated your online account before 3pm on Monday, 3 March 2025.

If you are sending your paperwork by post (rather than email), keep in mind that postal delivery times vary.

Members will have access to the same range of investment options for the merged fund as they do now.

There will be no change to the option(s) you are invested during the merger unless you choose to switch your investment options. Please note that that investment option switches will be temporarily unavailable during the limited service period.

If you want to make any changes to your investments before the LSP and hold an accumulation or pension account (excluding lifetime pensions), we’ll need to have received your paperwork before 5pm on Friday 28 February 2025 or you’ll need to have updated your online account before 3pm on Monday 28 February 2025.

If you are sending your paperwork by post (rather than email), keep in mind that postal delivery times vary.

Members will have access to the same range of investment options for the merged fund as they do now.

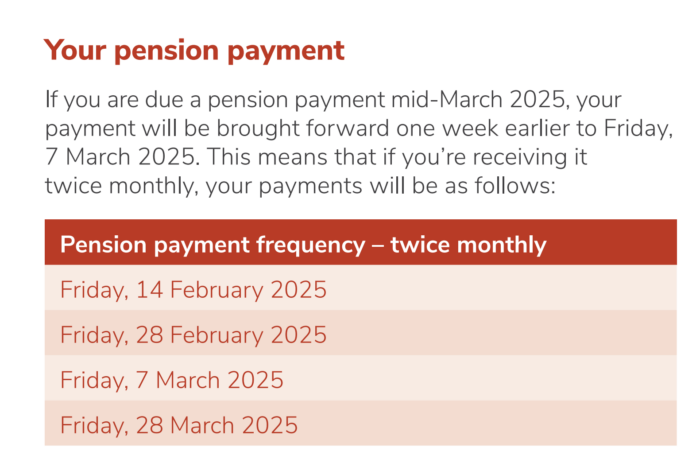

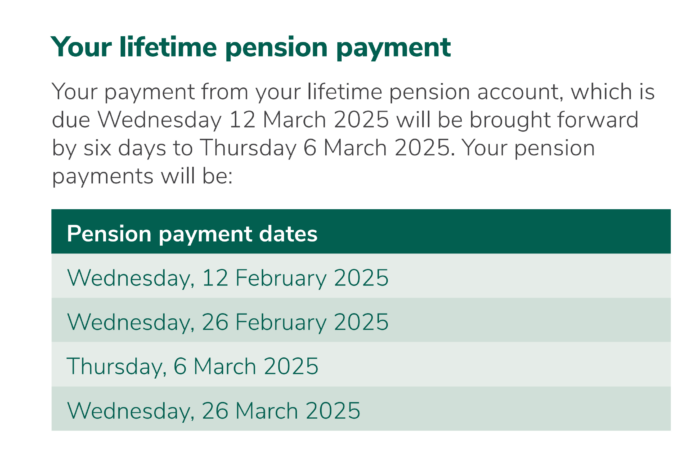

You can continue to choose to receive your pension payments twice monthly, monthly, bi- monthly, quarterly, four-monthly, six-monthly or annually. Pensions will continue to be paid on the 28th day of the month, with twice-monthly payments paid on the 14th and the 28th of the month. Those who receive twice-monthly payments will be affected by the limited service period and their payment scheduled for the 14 March will be brought forward one week earlier to Friday, 7 March 2025.

*If you have a lifetime pension, please check the relevant significant event notice as the payment frequency and dates are different to those listed above.

Your draw down method within the pension will not change as a result of the merger.

Your pension will generally continue to be paid on the same date as normal. The only exception to this is for those who receive twice-monthly payments and would usually receive a payment mid-March. Because of the limited service period, this payment will be brought forward one week earlier.

Any third-party authority you have assigned to your account will be maintained through the merger.

No changes are required, and you can still use your existing security questions as a member of the merged fund. To keep your money safe, we recently introduced two-factor authentication on the website, and for the app.

Not at all — the merged fund will have a broader geographic presence across NSW and Victoria, but our head office and contact centre will still be based in Melbourne and we will still have dedicated staff servicing the communities and our members throughout regional Victoria.

Even though we work on behalf of members across all industries to help them retire comfortably, we still retain a strong link to our local government heritage. This is the same for Active Super, formerly known as Local Government Super, which has traditionally been the industry super fund for current and former NSW local government employees. Together, we’ll have over 100 years of experience looking after the retirement benefits of workers in local government, water authorities and beyond.

We’ve been an industry fund since 1947 and that’s not going to change now. As an industry super fund, we’re run only to benefit our members and not the interests of external shareholders, so our focus is improving your returns and keeping your fees low.

The current Trustee of Vision Super – Vision Super Pty Ltd – will still be responsible for the overall governance and strategic direction of the merged fund known as Vision Super. From 1 March 2025, the Directors of the Trustee will be made up of directors from both Vision Super and the former Active Super boards. The Vision Super executive team will comprise of executives from Vision Super and Active Super. Details can be found on our website here from 1 March 2025.

Nothing about your defined benefit will change as a result of the merger. We know how important the defined benefit arrangements are to our defined benefit scheme members and can reassure you that nothing about the operation of the scheme or your entitlements will be altered.

Advice services will continue to be available to you during the merger, even during the LSP. However, depending on the date of your booking, the financial adviser may have limited information on your superannuation account available for the meeting. They will be able to discuss the best strategies to deal with this during your meeting.

All our current employer services will continue to be available to you as we progress through the merger transition. The current contribution remittance channels and payment methods will remain the same.

Yes, access to the clearing house will not be impacted by the merger.

You can continue to make employer contributions as normal throughout the merger. If a contribution is made during the limited service period, it won’t be processed until after normal service resumes no later than Tuesday 18 March 2025.

None of the fund information is changing so please continue to use the existing USI.

Employers won’t be required to change anything in the clearing house after the merger has taken place.

Your Vision Super employer account number will remain the same after the merger.

All members should have received a significant event notice relevant to the type of account they hold with Vision Super with important information about the merger. They can also visit www.visionsuper.com.au/merger to stay updated with the progress of the merger.

If I want to arrange for a workplace visit to explain the merger to members, is this possible?

Of course, please call our employer hotline on 1300 304 947 or email [email protected] to arrange for a Vision Super representative to come to your workplace.

If you have employees who are members of Active Super before the SFT date, Active Super will provide them with a significant event notice with details about changes to their Active Super account. If you have employees who are members of both Vision Super and Active Super before the SFT date, their accounts may be combined on or after the SFT date, but we’ll contact them with further details if this occurs.

Member Hotline

1300 300 820

Employer Hotline

1300 304 947

Retirement Hotline

1300 017 589