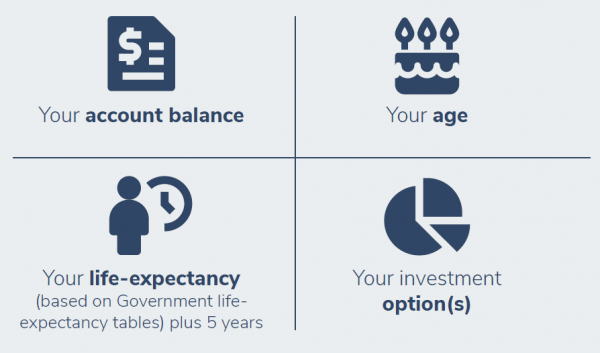

The Retirement Wage is an estimate of how much you can draw down from your Account based pension each year. Calculated annually, it’s designed to help you manage your retirement income with greater confidence.

Because it’s a yearly calculation based on your account information each June, your estimated Retirement Wage will change each year. This may be due to market fluctuations, lump sum withdrawals, alterations to your investment choice or changes to your pension drawdown rate throughout the year. Remember, the Retirement Wage calculation is a numerical calculation only, and optional for you to receive. If you do receive a Retirement Wage calculation, it’s up to you whether you adopt the calculated income level for your annual pension payment.

If you do not want to see an annual Retirement Wage calculation (using personal information we hold about you) in your annual drawdown letter, you can opt out at any time by contacting us on the details below.

Member Hotline

1300 300 820

Employer Hotline

1300 304 947

Retirement Hotline

1300 017 589