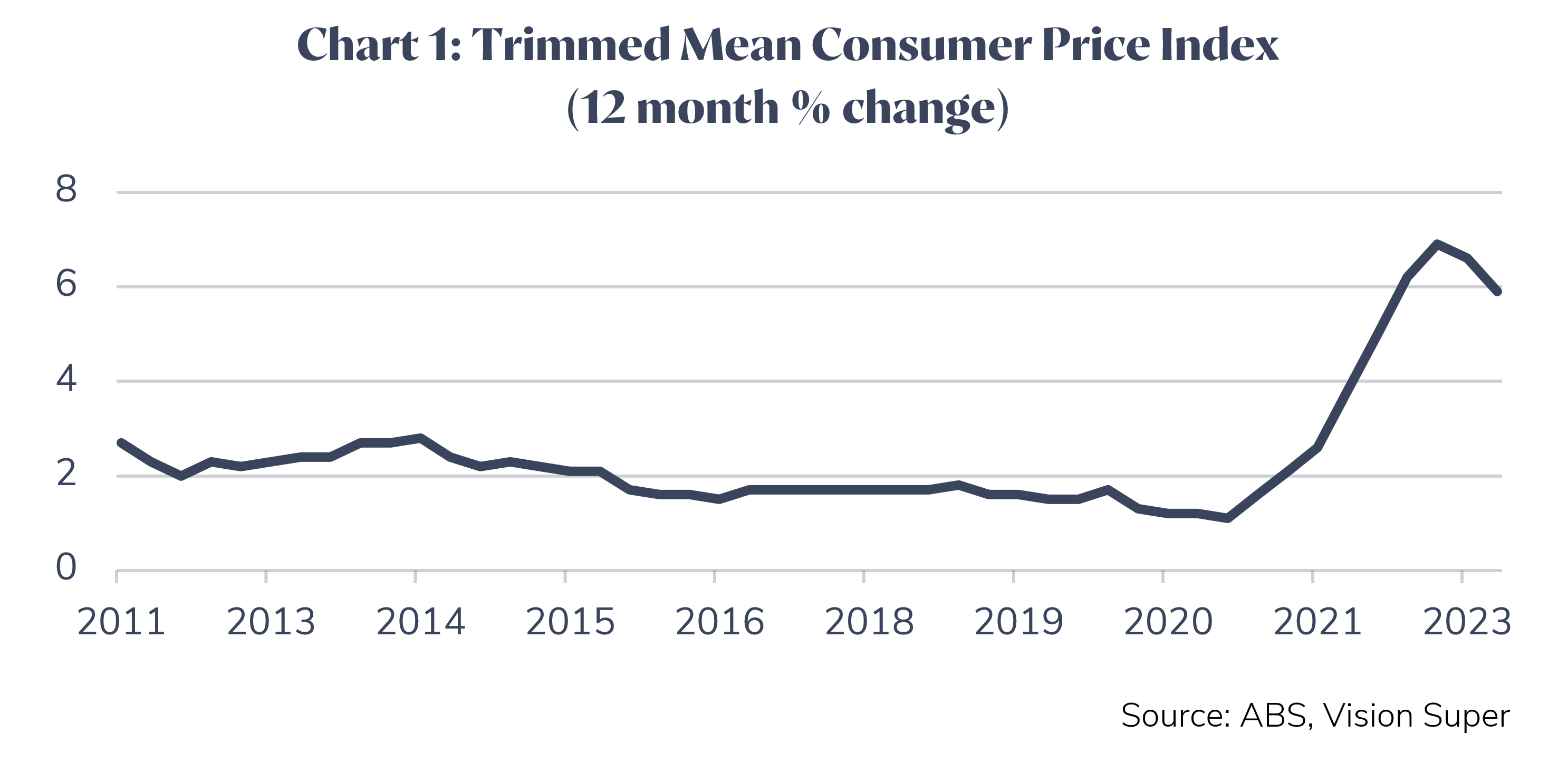

At the beginning of 2022, there was a large imbalance in global demand and supply, caused by surging demand alongside supply-chain issues. This resulted in elevated levels of inflation in many countries. Central banks, including the Reserve Bank of Australia (RBA), responded by aggressively increasing interest rates with the aim of reducing demand growth to help moderate inflation. Interest rates are now elevated versus the period immediately prior to the start of the pandemic and the growth rates of most developed economies have slowed. This slowing and reduced supply bottlenecks have resulted in inflation easing from peak levels. Chart 1 below shows the spike and subsequent fall in Australian underlying inflation during recent years. While inflation has fallen, it remains higher than the RBA’s 2% to 3% target range.

Despite the sharp rise in interest rates since the first half of 2022, Australian economic growth has been quite resilient over recent quarters. Gross Domestic Product expanded by 0.4% over the June 2023 quarter and by 2.1% over the year ending 30 June 2023, which is broadly consistent with a long-term average outcome.

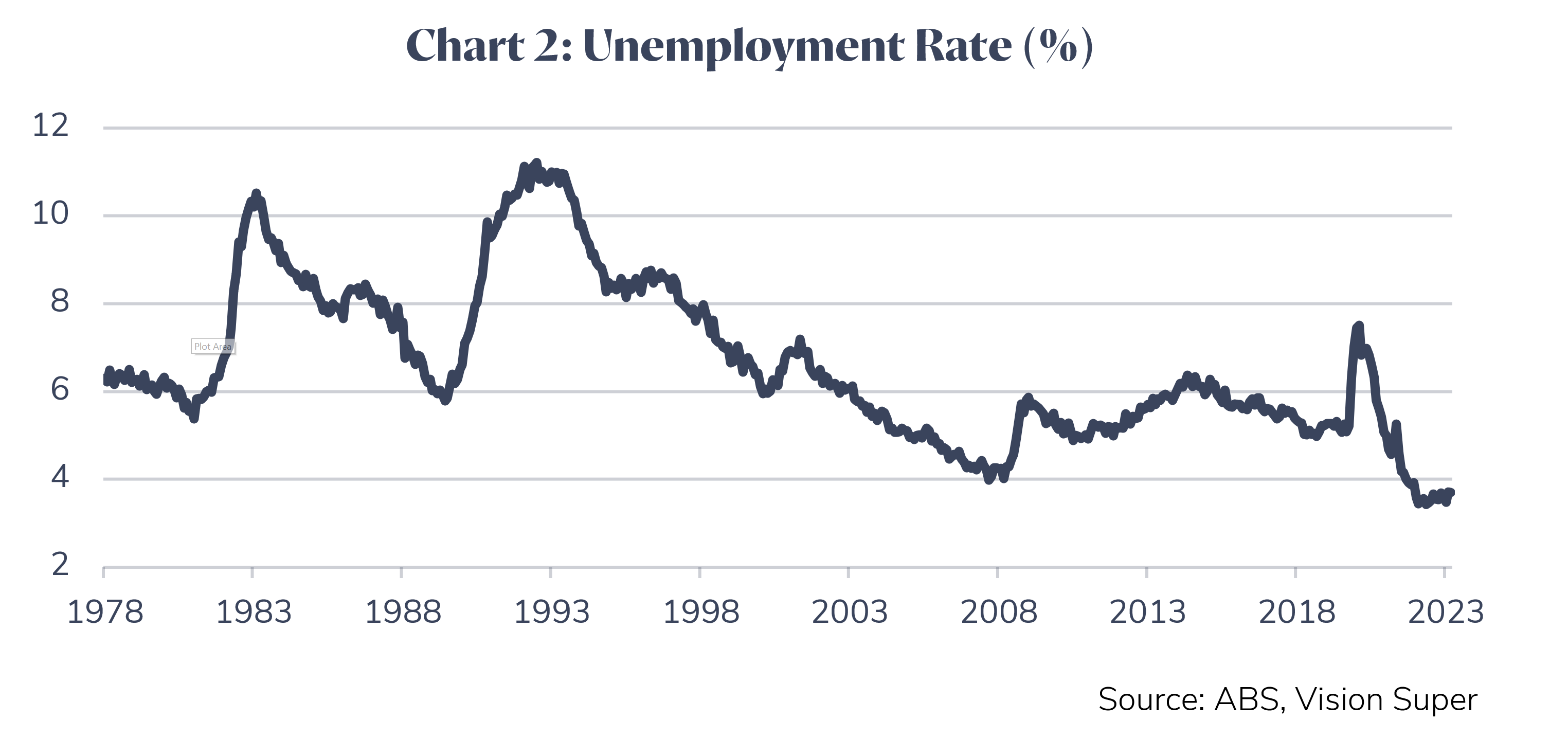

The Australian labour market is tight, with the unemployment rate close to historic lows (see Chart 2 below). However, it is likely that the full impact of interest rate rises has yet to be felt by the economy, as the transmission of monetary policy into the real economy often works with long and variable lags.

Looking forward, a key area of focus for investment markets is the labour market. The number of job advertisements has sharply declined recently, implying flat year-on-year employment growth in early 2024. Such an outcome would likely cause a material slowdown in Australian growth and may lead the RBA to seriously consider rate cuts, subject to the inflation outlook being consistent with their target range.

Two other key factors to monitor are the Australian housing market and China’s economic growth. House prices have increased over the last six months, but the rate of increase appears to be slowing. Many households will continue to feel the strain of high interest rates as more low-rate fixed loans expire and as pandemic savings decline. In China, growth has been lacklustre following the government’s easing of Covid restrictions late last year, with the property sector a key source of weakness. While our central case for the Australian economy over the next 12 to 18 months does not entail an Australian recession, the risk of such an outcome is materially higher than is usually the case.

Issued by Vision Super Pty Ltd ABN 50 082 924 561 AFSL 225054. This information is general advice which does not take into account your personal financial objectives, situation or needs. Before making a decision about Vision Super, you should think about your financial requirements and consider the relevant Product Disclosure Statement and Target Market Determination