For most of the time since the Reserve Bank of Australia (RBA) adopted an inflation target of 2% to 3%, inflation in Australia has been well controlled. That is not the case now. This has important implications for interest rates, housing, and the broader economy.

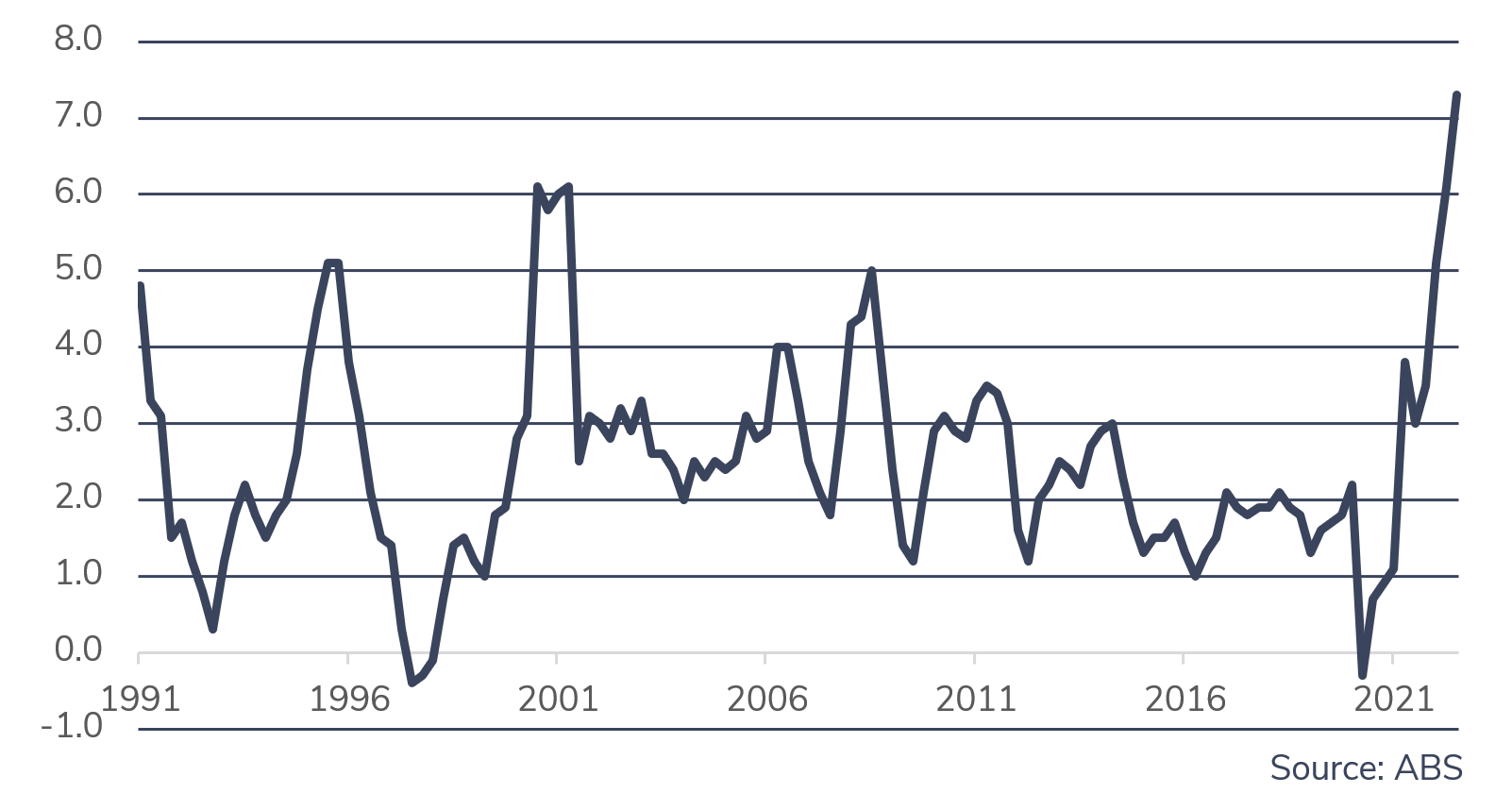

Australia’s inflation rate for the September quarter 2022 was 7.3%, which is its highest level in more than 30 years – see Figure 1. Australia is not alone, as most developed economies are also experiencing high inflation due to strong global demand and continued supply disruptions.

The large rise in Australian inflation over recent quarters is relatively broad based. Food and housing were the main contributors in the last 12 months. Domestically, heavy flooding in key growing areas has affected the price of fruit, vegetables and milk. Increasing housing costs has been driven by rising utilities bills and rents. Russia’s invasion of Ukraine has also continued to contribute to high prices for food, oil, and gas globally.

Figure 1: Australian Inflation (%)

High inflation is harmful, as it decreases the real buying power of your money. In response to recent high inflation, the RBA has increased its cash rate quickly from a low of 0.1% in April to 2.85% in November. The idea is to dampen demand. This should help with its aim of bringing inflation back to its target of 2-3% over the next few years.

One of the ways the cash rate affects the economy is through the housing market. An increase in interest rates increases households’ mortgage payments and decreases discretionary spending (part of demand). Most loans in Australia are variable loans which quickly reflect the change in the cash rate. This, coupled with the high level of household debt, mean that an increasing proportion of Australian households will likely experience difficult conditions in 2023.

We expect that the Australian economy will slow over coming quarters, with a higher-than-normal risk of recession in 2023. The degree to which the consumer is resilient is likely to be a key factor in determining whether this recession risk eventuates. In part, reflecting this risk, Vision Super’s multi-asset class investment options currently have a moderately lower allocation to Australian Equities than is expected over the long term.

Investment returns are not guaranteed. Past performance is not a reliable indicator of future returns. This information is general advice which does not take into account your personal financial objectives, situation or needs. Before making a decision about Vision Super, you should think about your financial requirements and consider the relevant Product Disclosure Statement and Target Market Determination issued by Vision Super Pty Ltd ABN 50 082 924 561 AFSL 225054 PDSs and TMDs can be found here.