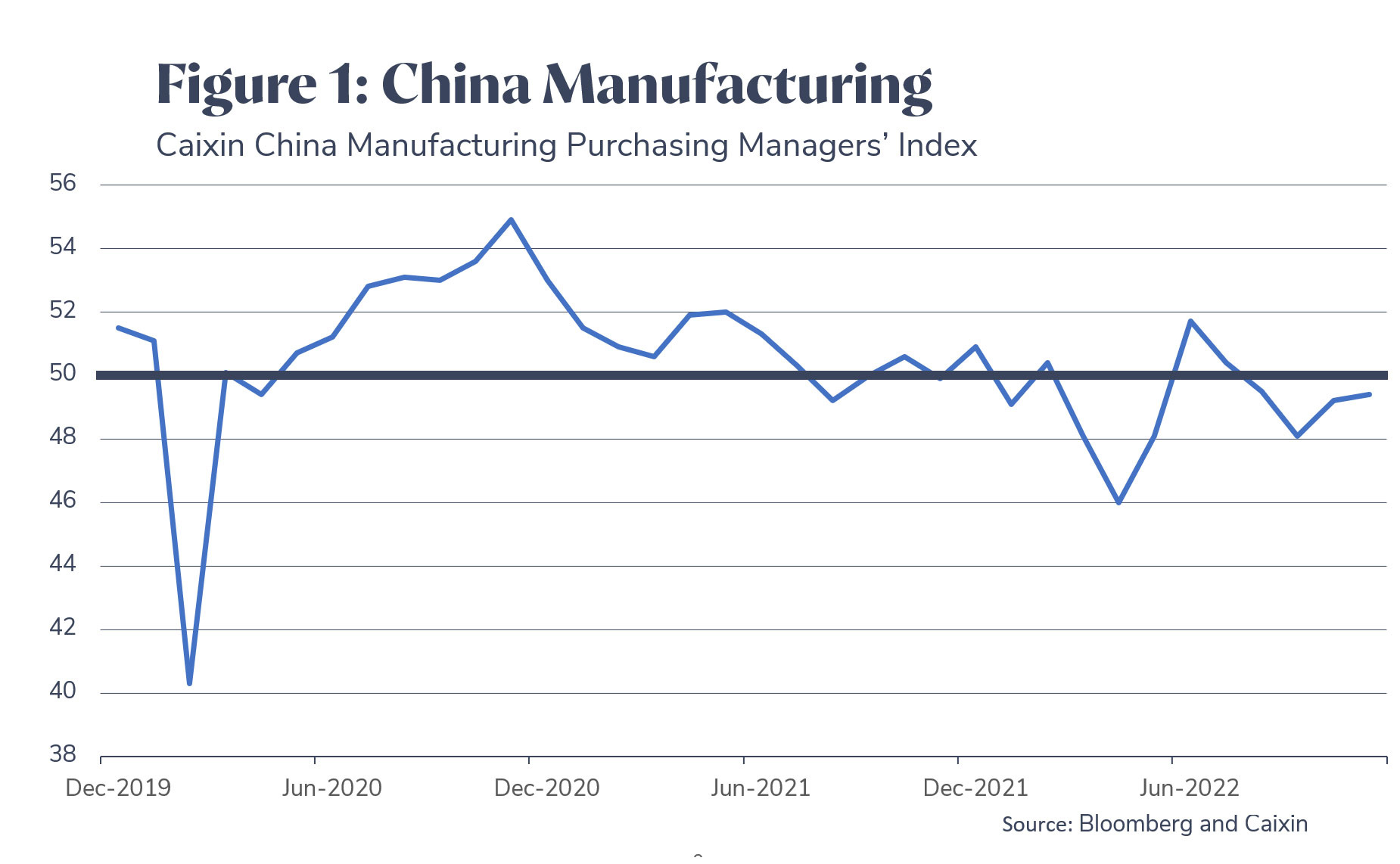

COVID-19 was first identified in China around three years ago and the outbreak of the virus has resulted in a global pandemic. China continues to grapple with how to manage the virus and has been enforcing tight restrictions as part of its ‘dynamic-zero’ Covid policy. The stringent approach has kept reported cases and deaths low at the expense of a slowing economy. Figure 1 shows China’s Purchasing Managers’ Index (PMI), a measure of Chinese manufacturing activity. A PMI above 50 indicates an expansion, while a number below 50 represents a contraction. The chart shows that China’s strict Covid policy has resulted in a contracting manufacturing sector during some periods in 2022.

Over recent weeks, there has been nationwide protests against the strict Covid controls and lockdowns. Many workers abandoned cities with major lockdowns. As a result, companies such as Apple have announced shipping delays, as well as accelerating plans to diversify manufacturing away from China.

Authorities have since relaxed many Covid restrictions. This has provided a significant boost to Chinese equities (see figure 2), with the Hang Seng Index increasing over 10% from 28 November 2022 to 8 December 2022. The effect on the global economy of a Chinese reopening is likely to be positive by increasing demand and improving supply-chains, and this effect may be magnified for countries such as Australia that have high trade linkages to China.

China faces two key issues in completely reopening its economy: the low efficacy of Chinese vaccines relative to its mRNA counterparts and the low rate at which the elderly population are being vaccinated. As a result, if China decides to materially reduce its Covid restrictions, it risks facing a sharp increase in cases and deaths. If this does transpire, the Chinese government may reintroduce harsh widespread lockdowns. We expect that until China can deploy highly effective mRNA Covid vaccines across a high proportion of its population, the Chinese economy will remain relatively constrained and not be able to operate at close to full capacity.

Investment returns are not guaranteed. Past performance is not a reliable indicator of future returns.

This information is general advice which does not take into account your personal financial objectives, situation or needs. Before making a decision about Vision Super, you should think about your financial requirements and consider the relevant Product Disclosure Statement and Target Market Determination issued by Vision Super Pty Ltd ABN 50 082 924 561 AFSL 225054 at www.visionsuper.com.au