This article takes a brief look at recent developments in China.

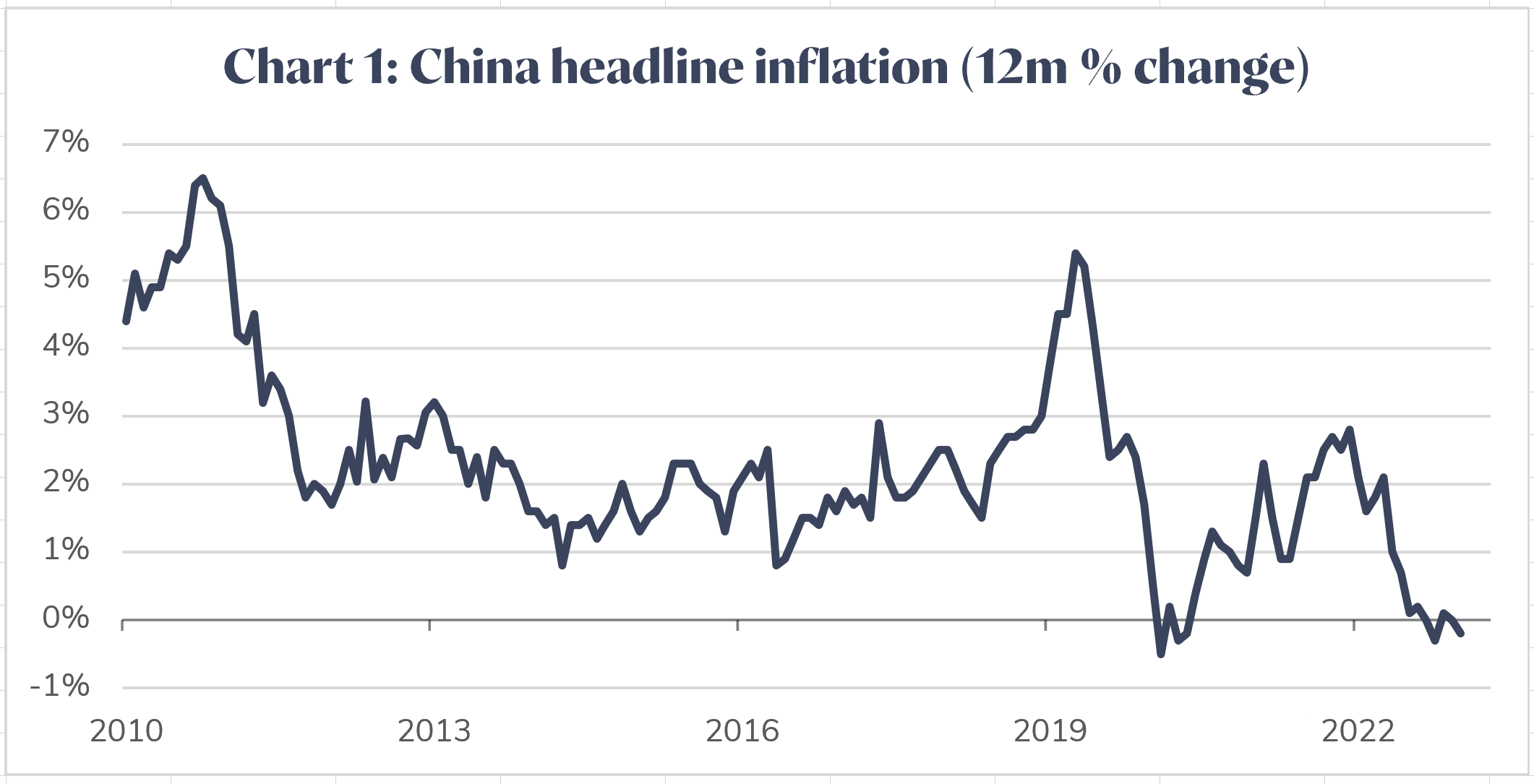

In late 2022, China started lifting its Covid restrictions and reopened its economy. While there was a surge in activity initially, it did not last long as medium-term structural challenges (overbuilding, high debt levels and a declining working-age population) provided a material headwind. China’s economic recovery has been weak and this has contributed to falling inflation (see Chart 1 below). China is one of the few countries that has not experienced high inflation over recent years.

While the Chinese government has implemented some monetary and fiscal stimulus recently, this has been piecemeal and small relative to history, due to factors such as high debt levels and overbuilding.

Source: LSEG Refinitiv

China is facing a material medium-term challenge in its property and infrastructure sectors. These sectors have been dominant drivers of Chinese growth in recent decades, which has been underpinned by rapid increases in debt and has resulted in overbuilding. Property inventory levels are very elevated, which places downward pressure on property prices. Several major Chinese property developers, including Country Garden, have experienced large falls in their stock prices over recent years.

Another factor that has weighed on Chinese growth is a shrinking population with an increasing average age. Based on World Bank estimates, the Chinese working age population peaked in 2015 and has been declining gradually since then. The World Health Organization estimates that the proportion of China’s population over 60 will reach 28% by 2040 [1]. On top of a declining labour force, China also faces slower productivity growth and diminishing returns to investments versus recent decades. With the aim of adapting its economy to key sources of global growth, China has invested heavily in areas such as artificial intelligence, batteries, semi-conductors and electric vehicles.

China remains Australia’s largest trading partner, accounting for 28% of Australia’s exports in 2022[2] predominantly iron ore, lithium and coal. While China is trying to stimulate its economy, a material boom in commodity prices from such stimulus looks unlikely at this stage as the degree of stimulus is constrained by high debt levels and excess capacity.

It is possible that China eventually chooses to stimulate aggressively if its economy materially worsens and/or if there is civil unrest. In this scenario, China may do this in a manner that is less resources intensive than in the past (eg through cash payments to households), which would mean that a commodities boom is unlikely. Alternatively, it could decide to stimulate in a similar way as previously even though it would add to its excess capacity. This would likely materially boost commodity prices during the building phase.

Investment returns are not guaranteed. Past performance is not a reliable indicator of future returns.

Issued by Vision Super Pty Ltd ABN 50 082 924 561 AFSL 225054. This information is general advice which does not take into account your personal financial objectives, situation or needs. Before making a decision about Vision Super, you should think about your financial requirements and consider the relevant Product Disclosure Statement and Target Market Determination