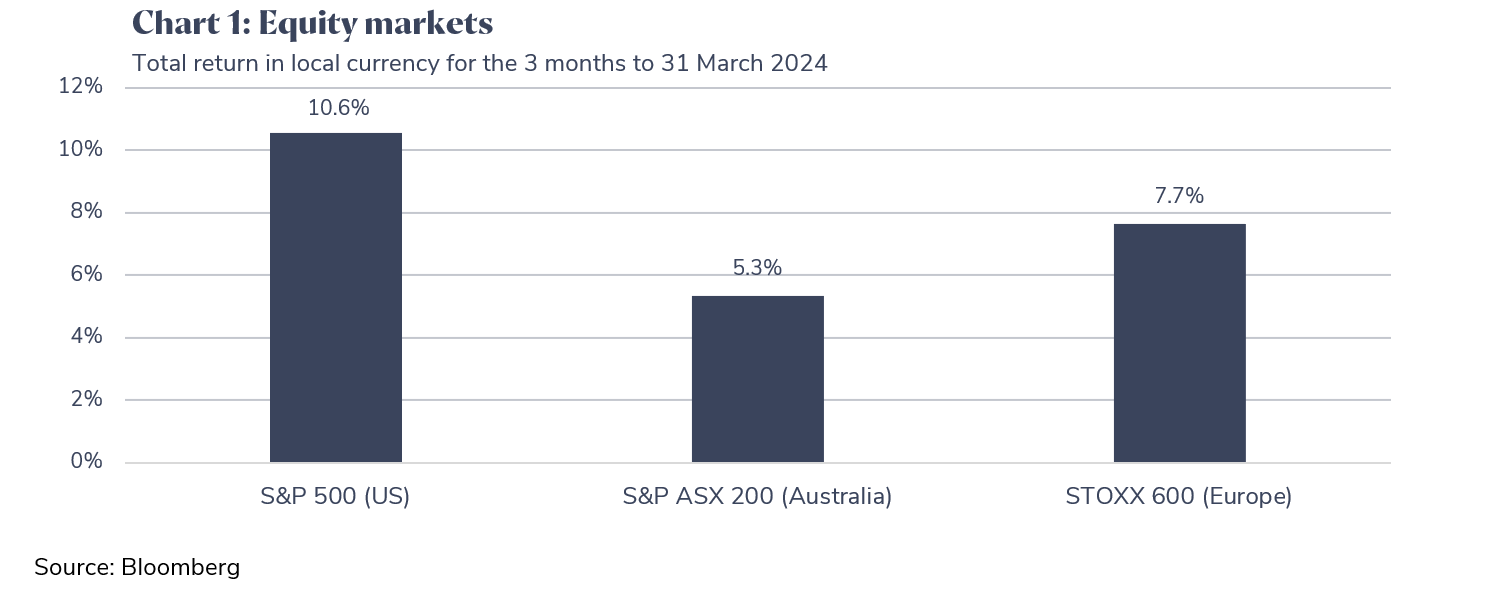

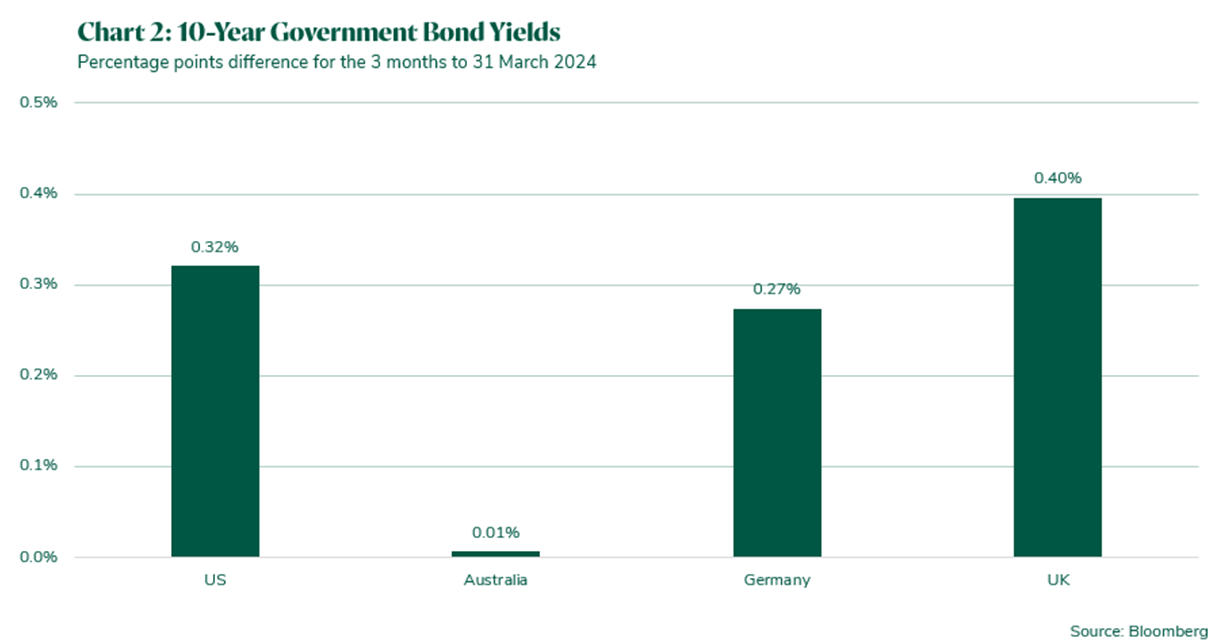

The performance of global equity markets was very strong in the first quarter of the year with the US market particularly strong (see Chart 1). Global long-term interest rates increased (see Chart 2) as US inflation was stronger than expected, remaining above the US Federal Reserve’s 2% target. Overall, Vision Super’s Balanced growth accumulation option performed favourably, returning 4.59% in the quarter and 11.83% over a one-year period ending 31 March 2024. The Pension Balanced growth option also performed strongly, returning 5.07% in the quarter and 12.18% over one year to 31 March 2024.

Artificial intelligence (AI) and the US equity market

During the March quarter, gains in the US equity market were underpinned by technology stocks, particularly those expected to benefit from generative AI. This rally has resulted in an exceptionally concentrated market, with the 10 largest US stocks now representing over 30% of the S&P 500 index. As a result of the recent gains in the S&P 500 index, its price to earnings ratio (a commonly used valuation metric) is now around 30% above its median level over the past 30 years. This suggests that the medium-term returns from this market are likely to be below average and increases the risk of a meaningful downward move in that market should the current strong earnings growth consensus expectations not be realised.

US inflation and labour market

US inflation has decreased materially since its peak in 2022, boosting real income growth. However, it has surprised on the upside over the past couple of months. The services component of inflation is elevated, as wage growth remains high. The unemployment rate has increased by 0.4% from its April 2023 low but the level of unemployment is still relatively low versus history.

Central banks and interest rates

Global interest rates are elevated compared with two years ago. Given higher-than-expected inflation data in the first quarter of 2024, the probability of interest rates staying higher for longer has risen. This has resulted in markets delaying their expectation of the first interest rate cuts by major central banks to around the middle of this year.

China

The Chinese economy continues to face material growth headwinds from its property sector. Household sentiment in China is weak and consumers are less inclined to borrow or spend versus a few years ago. The government has implemented some stimulative policies recently and its manufacturing cycle appears to be rebounding. However, stimulus by policymakers has been piecemeal and is unlikely to be meaningful enough to materially reinvigorate growth.

Australia

The Australian economy has been slowing over recent quarters, with GDP growing by 1.5% over the year to the December 2023 quarter. On a per capita basis, GDP contracted by 1.0% over this period, reflecting weak productivity growth. While the economy has slowed, employment growth has been relatively robust, with employment increasing by 3.2% over the year to February 2024. While there has been a meaningful fall in inflation since the peak in 2022, the RBA’s underlying inflation measure remained above 4% over the year to the December quarter 2023.

Investment outlook

Despite significant interest rate rises, the US economy has been resilient, reflecting factors such as savings households accumulated during the early phase of the pandemic and low borrowing rates locked in by corporates at the start of the pandemic. Partly reflecting this resilience, investors are generally expecting that the US economy will achieve a soft landing in 2024, with a meaningful rise in profit growth over coming quarters and inflation becoming more aligned with the Fed’s 2% target. Such an outcome would likely support global equity markets, although much of this view appears to be in current pricing, limiting the potential upside in 2024. Conversely, if earnings growth is weak over coming quarters because of factors such as the lagged impact of interest rate increases or inflation is higher than expected, equity markets would likely experience some downside pressure.

In addition to the US macroeconomic environment, other factors that may influence investment markets over the next 12 to 18 months include the outcome of the US election, as well as geopolitical developments in the Middle East and Ukraine. Recently, such factors have not had a material impact on investment markets.

Investment returns are not guaranteed. Past performance is not a reliable indicator of future returns.