Global equity markets have been relatively robust over the quarter and financial year amid a rising interest rate environment. Our Balanced Growth investment option returned 2.97% over the June 2023 quarter and 10.96% for the financial year.

Compared with other MySuper investment options, our Balanced growth option return for FY2023 was very favourable (ranked 2nd out of 41) – see table below in a widely used survey. Over the five years to 30 June 2023, the Balanced growth option is ranked 5th out of 39 in the SuperRatings survey as outlined in the table below.

Table 1: Balanced growth performance (periods ending 30 June 2023)

| 1 year | 3 years | 5 years | |

|---|---|---|---|

| Return (annualised) | 10.96% | 8.32% | 6.82% |

| Rank* | 2 out of 41 funds | 9 out of 41 funds | 5 out of 39 funds |

* SuperRatings Fund Crediting Rate survey, SR50 MySuper Index, June 2023

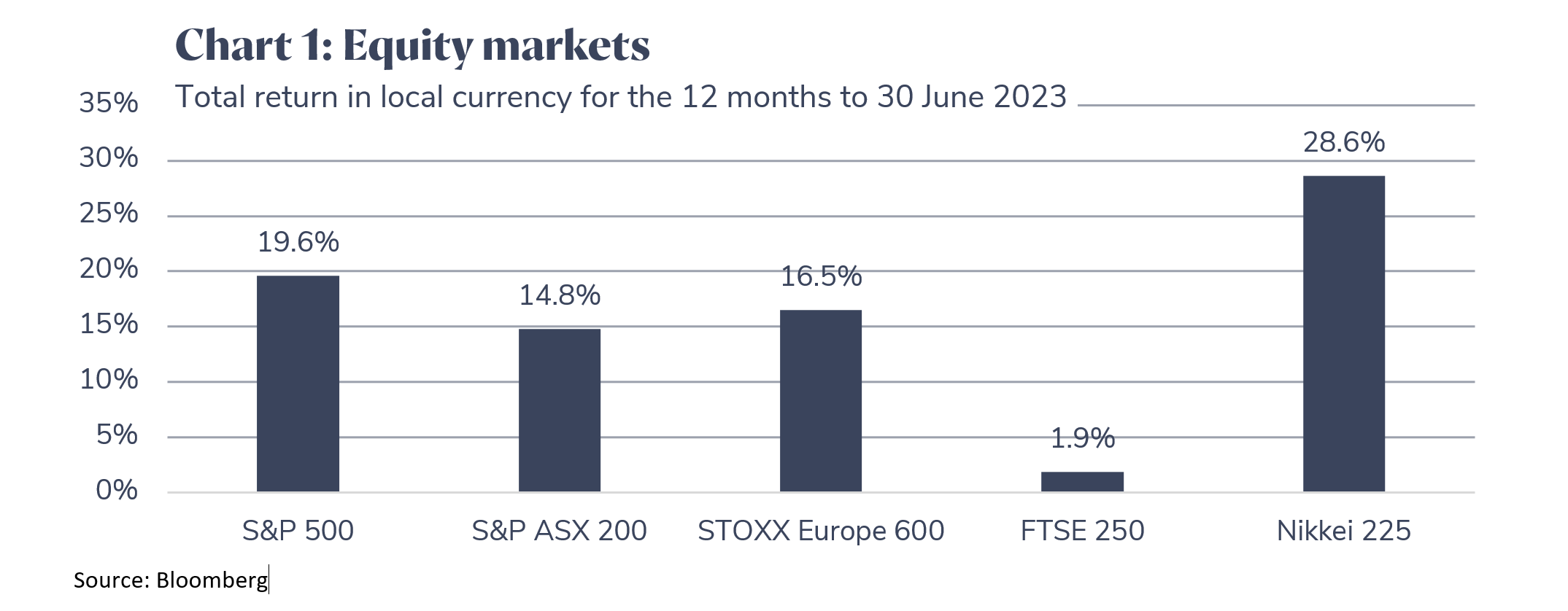

Global equity markets have risen over the financial year (see Chart 1), supported by factors such as: markets pricing less concern about US inflation; a relatively resilient US economy; the emergence of generative Artificial Intelligence (AI); a positive resolution on the US debt ceiling; and some unwinding of negative investor sentiment. The main driver of the rise in equity markets has been rising valuations rather than profits. For example, US profits on a rolling 12-month basis have been contracting moderately over recent quarters.

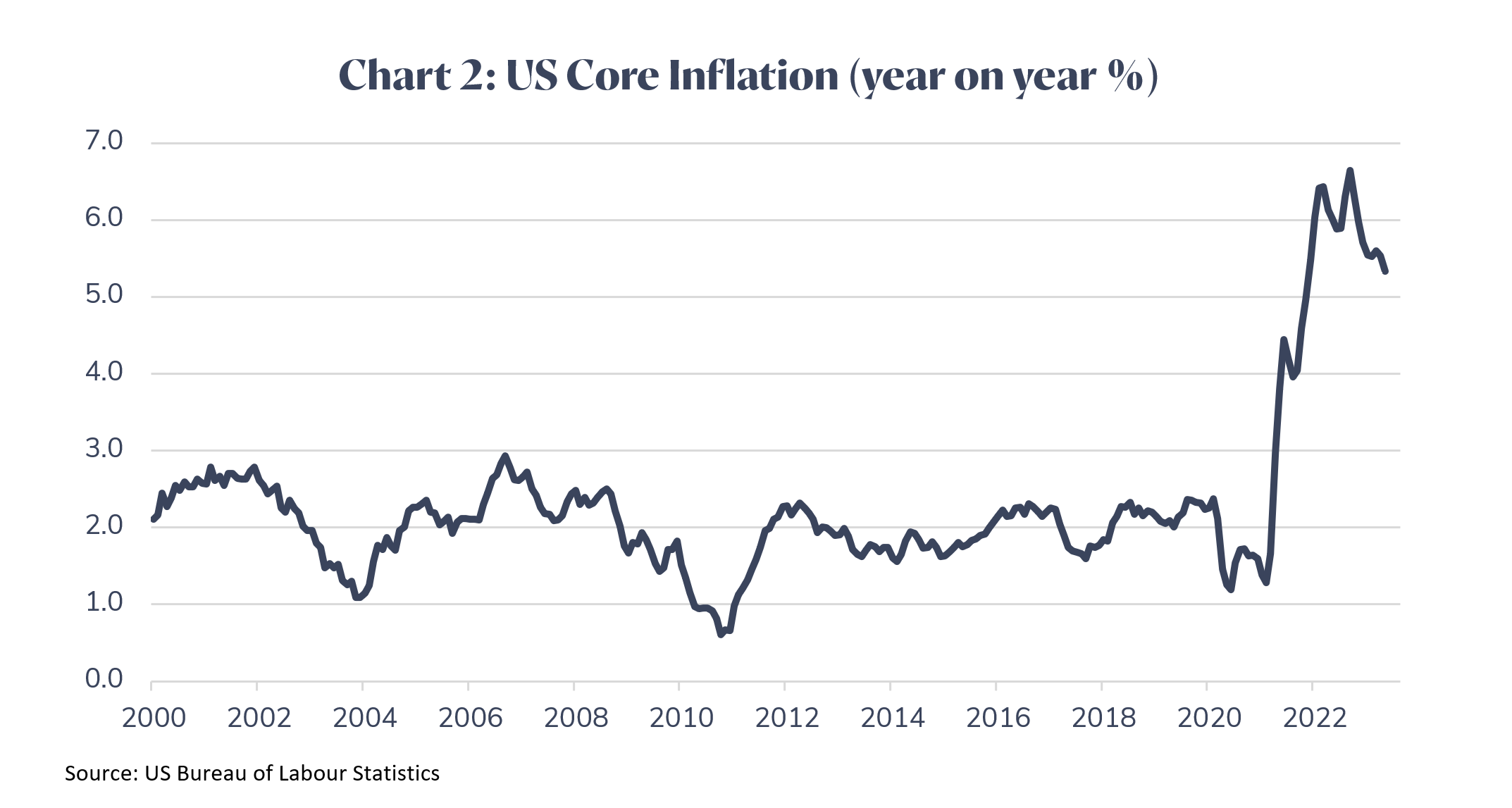

US inflation appears likely to fall materially over the next year or so, which enabled the Federal Reserve to pause on raising rates in June. However, Fed officials are suggesting that some further rate increases may be required. The chart below shows US core inflation falling moderately from its peak.

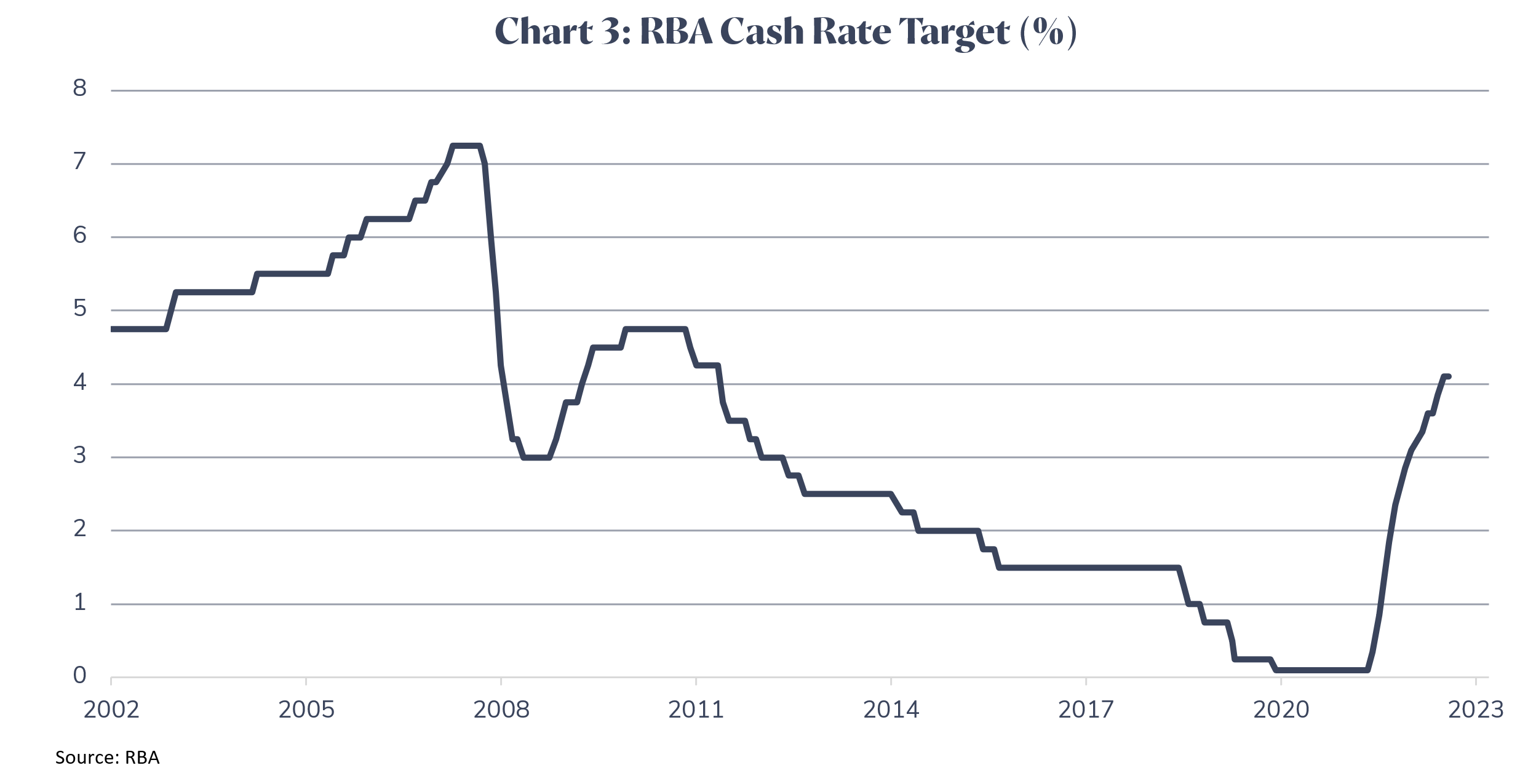

Relative to the US, Australia has experienced more elevated inflation pressures recently. Across Australia’s capital cities, housing rents have surged by over 10% during the 12 months to June 2023 according to CoreLogic. This has reflected factors such as high immigration levels and limited housing supply. Consequently, the Reserve Bank of Australia (RBA) increased the cash rate by 0.25% at both its May and June meetings, following a pause in April. In July, it decided to pause again but still has a bias to increase interest rates further. The market is anticipating one or two additional increases over coming months.

One notable theme driving equity markets recently is AI, with AI-related stocks like computer chip design firm Nvidia increasing sharply. The recent development of generative AI capability, such as ChatGPT, has the potential to significantly enhance productivity in the medium term. However, this advancement brings challenges relating to aspects such as ethical concerns and data quality. Investor enthusiasm in relation to AI has contributed to the recent rally in the US equity markets which has been very narrow, with a large proportion of the gains in the S&P 500 index concentrated in large technology stocks.

While the US banking sector came under pressure after three midsize banks collapsed in March 2023, investors are largely pricing this issue as being isolated to the banking sector. However, the growth in US bank lending has slowed materially since the end of 2022 and further slowing appears likely. We expect that this will underpin weaker US economic and profit growth.

Outlook

Relative to the start of 2022, the global economy is more balanced, with less inflation pressure. However, the full impact of the rapid rise in interest rates in most parts of the world over the past year or so is yet to be felt. We anticipate that this will occur during the remainder of 2023 and in 2024. Labour markets remain at very tight levels in the developed world and further rate rises may be required as central banks continue to try and reign in demand. The combined impact of rate rises is likely to be a recession in the US and other developed economies. In this environment, profits are expected to contract, putting some downward pressure on equity markets. The main upside risk to this view is that inflation falls back to levels consistent with central banks’ targets without a material slowdown in economic growth.

Investment returns are not guaranteed. Past performance is not a reliable indicator of future returns.

*This information is general advice which does not take into account your personal financial objectives, situation or needs. Before making a decision about Vision Super, you should think about your financial requirements and consider the relevant Product Disclosure Statement and Target Market Determination. Issued by Vision Super Pty Ltd ABN 50 082 924 561 AFSL 225054.