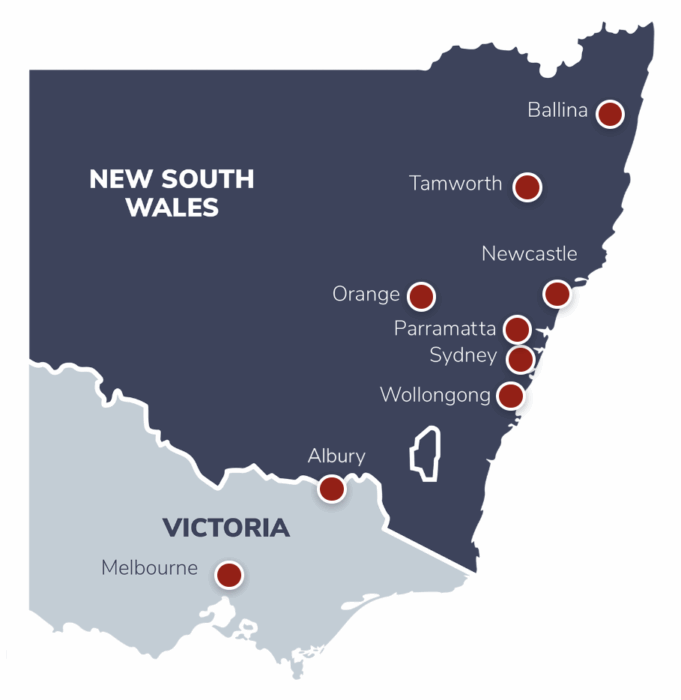

Following the merger, some members have been asking if the fund is now Melbourne-based. The answer is ‘No’! Service is at the heart of what we do, so we’re excited to have an even larger presence now that we have offices in both Sydney and Melbourne as well as people on the ground throughout NSW and Victoria.

If you work for a local council, or for an organisation or company that employs a large number of our members, you’ll continue to see our dedicated Customer Relationship Managers visiting your workplace. They can help with any general questions you have about super and they also run seminars and education sessions at your work to help you make the most of your super.

Our friendly contact centre teams based in Melbourne and Sydney are also here to help you. We don’t make you navigate through multiple options entering numbers – you just call, and we answer (during office hours). You’re also welcome to make an appointment to meet with our Member Services team in person (you’ll find our contact details below).

While face-to-face contact is important, we know that life is busy and many of you simply want to be able to access our services how and when suits you. So we also have a range of ‘self service’ tools and resources available online via our website and the app.

If you feel you need more personalised financial advice tailored to your specific circumstances, we have financial planners available throughout Victoria and NSW. There’s no charge for the first session and we’ll let you know what the fees will be before we go ahead, so you can decide whether you want to continue.

We believe our service really sets us apart. So if you have any questions about your super or preparing for retirement, please feel free to reach out to us. We’re here to help.

Office locations

Member services: 1300 300 820

Employer services: 1300 304 947

Vision Super Financial Planners are employees of the Trustee (or a related entity) that are authorised to provide financial advice as representatives of Industry Fund Services Limited (IFSL) ABN 54 007 016 195 AFSL 232 514. Any financial advice provided by a Vision Super Financial Planner is issued on behalf of IFSL, not their employer. Vision Super Financial Planners can provide financial advice including personal advice about Vision Super that takes into account your personal circumstances.

Before making a decision in relation to any of our products, you should read the appropriate Vision Super Product Disclosure Statement and Target Market Determination (TMD) or appropriate Active Super Product Disclosure Statement and TMD at activesuper.com.au